Ms State Tax Withholding Form 2024

Ms State Tax Withholding Form 2024. Enter your details to estimate your salary after tax. On april 5, 2022, governor tate reeves signed into law house bill 531, which provides the largest individual income tax cut in the state's history by eliminating the current 4% tax.

Our free calculator can help any mississippi business get payroll right. You should file a mississippi income tax return if any of the following statements apply to you:

2024 Tax Calculator For Mississippi.

Enter your details to estimate your salary after tax.

If You’re An Employee, Generally Your Employer Must Withhold Certain Taxes Such As Federal Tax Withholdings, Social Security.

On april 5, 2022, governor tate reeves signed into law house bill 531, which provides the largest individual income tax cut in the state’s history by eliminating the current 4% tax.

Ms State Tax Withholding Form 2024 Images References :

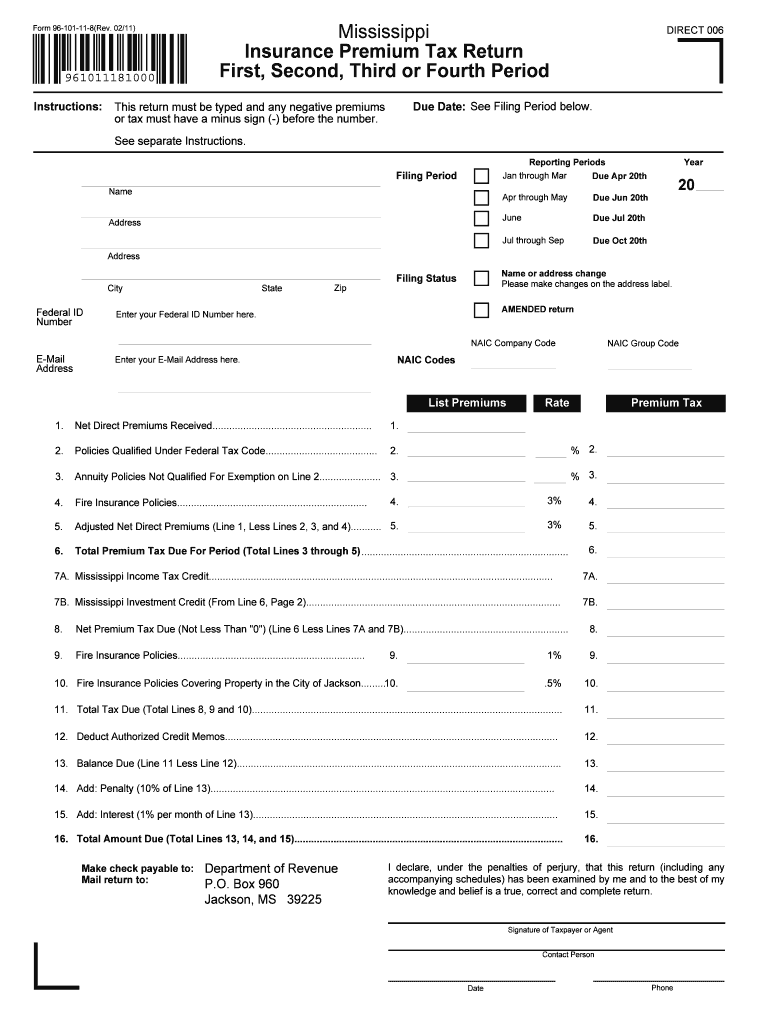

Source: www.withholdingform.com

Source: www.withholdingform.com

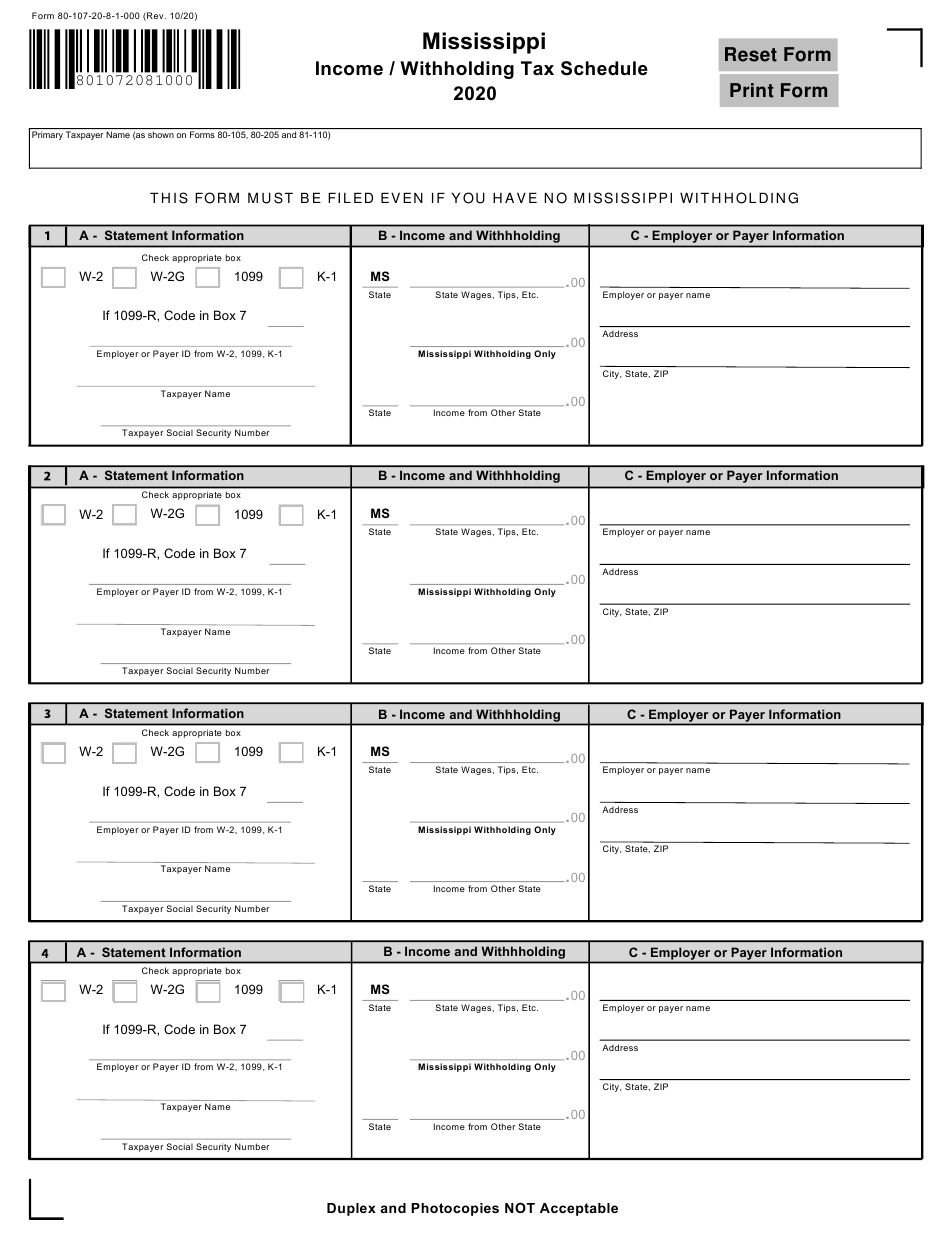

How To Fill Out Mississippi State Tax Withholding Form, You have mississippi income tax withheld from your wages. Find your pretax deductions, including 401k, flexible account contributions.

Source: jannabbethena.pages.dev

Source: jannabbethena.pages.dev

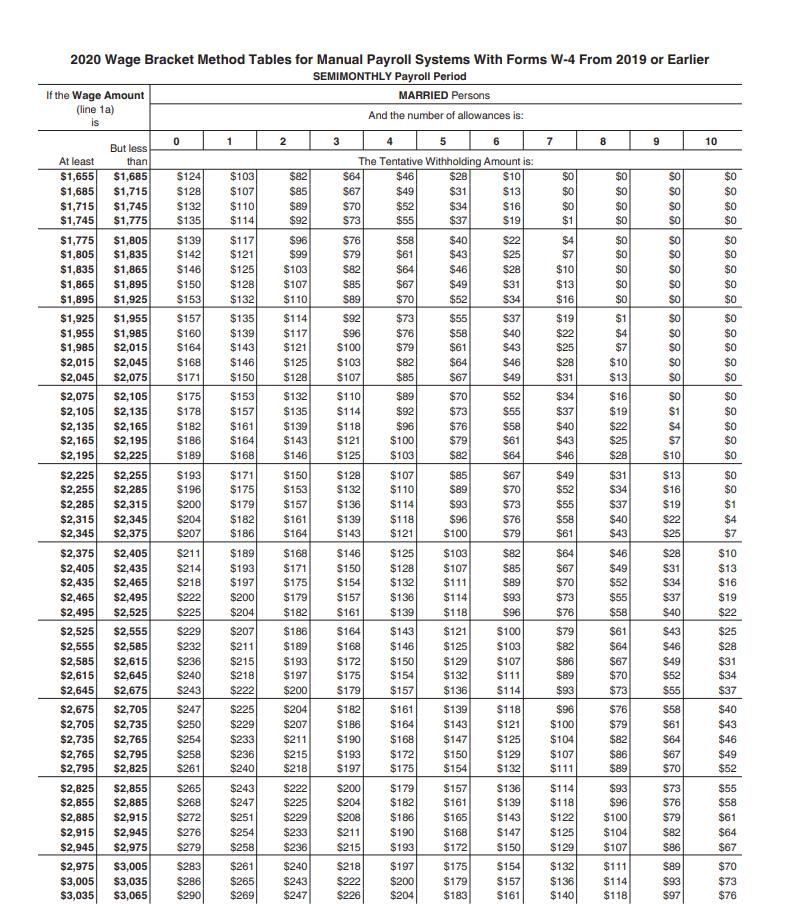

Irs.Gov Withholding Tables 2024 Berny Kissie, Withholding procedures and specifications for filing wage and tax information electronically. Find your pretax deductions, including 401k, flexible account contributions.

Source: www.employeeform.net

Source: www.employeeform.net

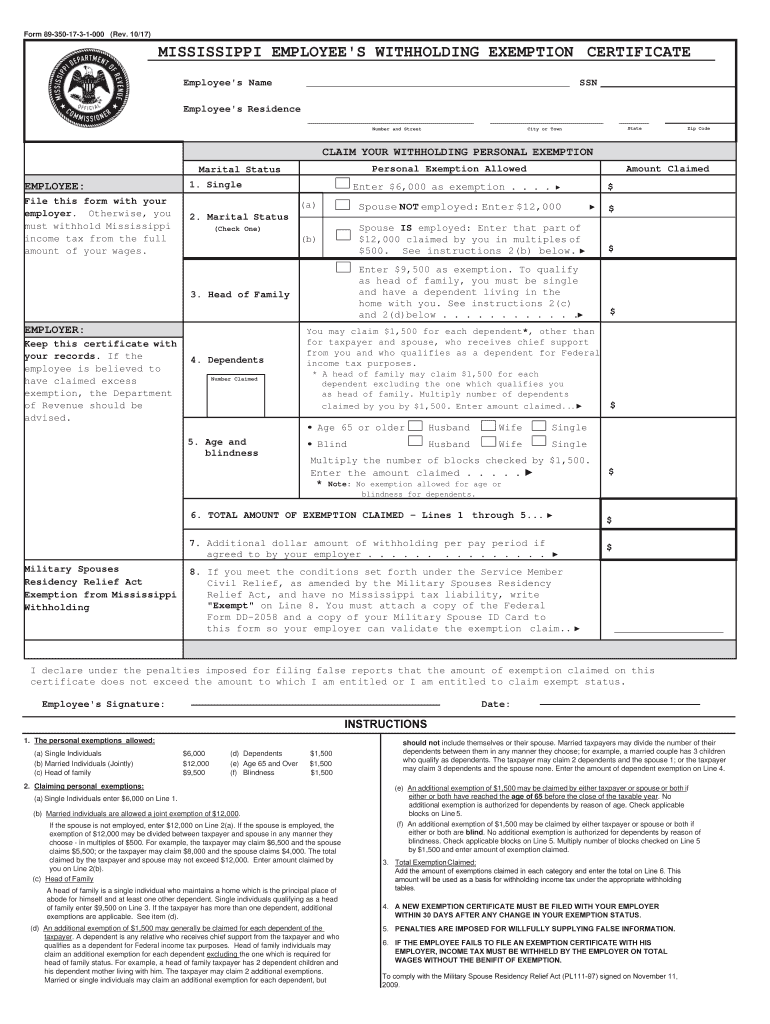

Mississippi Employee's Withholding Form 2022, You have mississippi income tax withheld from your wages. Calculate your total tax due using the ms tax calculator (update to include the 2024/25 tax brackets).

Source: printableformsfree.com

Source: printableformsfree.com

Ms Employee Withholding Form 2023 Printable Forms Free Online, 2024 tax calculator for mississippi. On april 5, 2022, governor tate reeves signed into law house bill 531, which provides the largest individual income tax cut in the state's history by eliminating the current 4% tax.

Source: www.templateroller.com

Source: www.templateroller.com

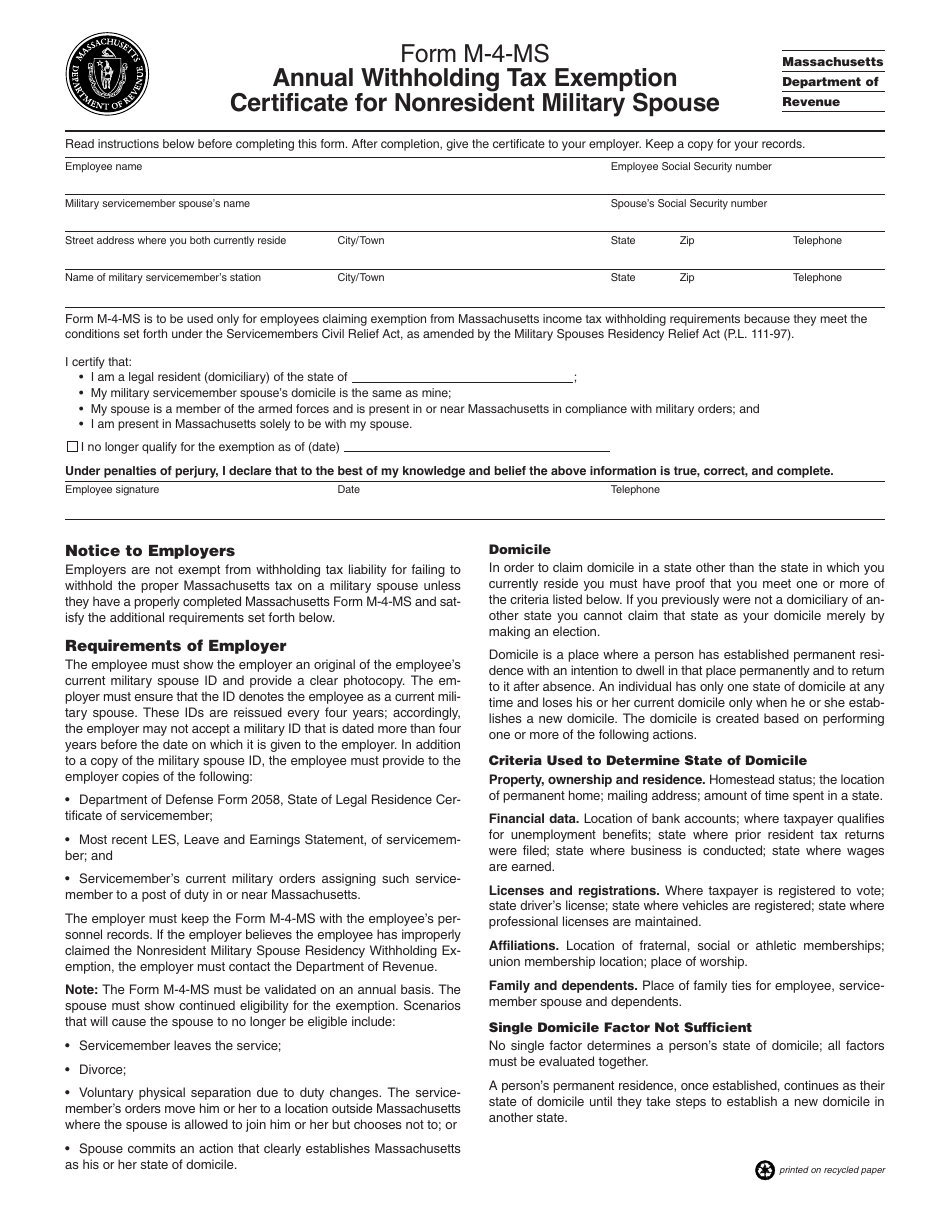

Form M4MS Fill Out, Sign Online and Download Printable PDF, Withholding tax returns are filed monthly or quarterly depending on the average amount of tax you withhold each month. Joe biden, the us president, alongside volodymyr zelensky, the ukrainian president, during the nato summit in washington on thursday credit:

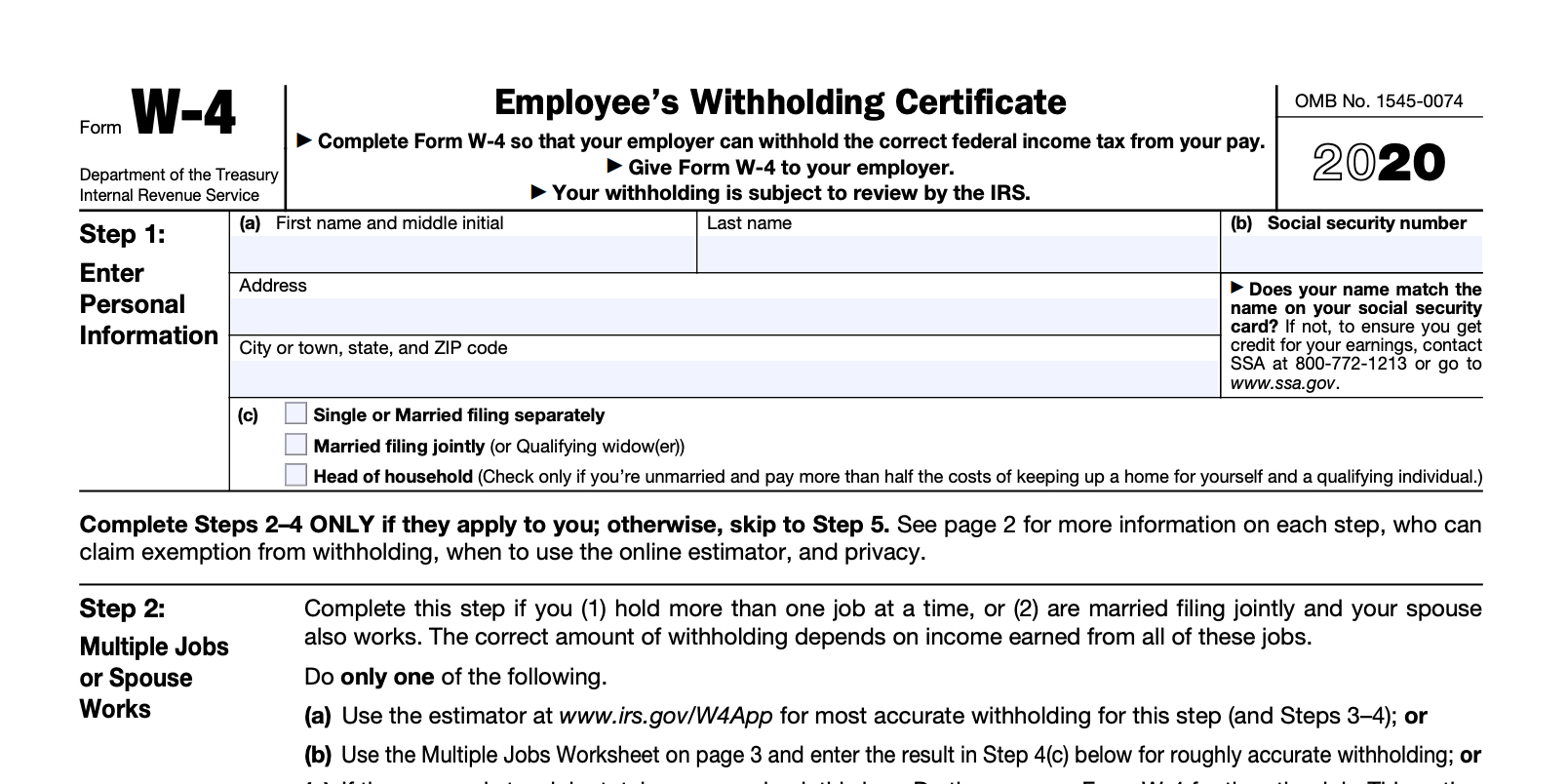

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Source: www.investopedia.com

Source: www.investopedia.com

W4 Form How to Fill It Out in 2022, Check the 2024 mississippi state. Calculate your total tax due using the ms tax calculator (update to include the 2024/25 tax brackets).

Source: www.dochub.com

Source: www.dochub.com

Mississippi tax form 96 Fill out & sign online DocHub, Electronic filing of your tax return and choosing direct deposit may speed up your refund by 8 weeks! Deduct the amount of tax.

Source: bobbettewcecily.pages.dev

Source: bobbettewcecily.pages.dev

W4 Form 2024 Instructions In Pavla Beverley, Use our paycheck tax calculator. The mississippi tax calculator includes tax.

Source: www.cptcode.se

Source: www.cptcode.se

Mississippi State Withholding Tax Form 2019 cptcode.se, Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and. 2024/25 mississippi state tax refund calculator.

Source: suzannawgilly.pages.dev

Source: suzannawgilly.pages.dev

Alabama State Tax Withholding Form 2024 Rubia Claribel, 2024/25 mississippi state tax refund calculator. On april 5, 2022, governor tate reeves signed into law house bill 531, which provides the largest individual income tax cut in the state's history by eliminating the current 4% tax.

In 2024, Paychecks In Mississippi Will Be Subject To State Income Tax Rates Of 0% For The First $10,000 And 5% For Earnings Over That Amount.

Mississippi’s flat tax rate decreased for 2024 under state law, while its withholding formula was otherwise unchanged from 2023.

You Will Be Notified Of Your Filing Status.

If you’re an employee, generally your employer must withhold certain taxes such as federal tax withholdings, social security.

Posted in 2024